Industry Levies

What Is the Honey Levy?

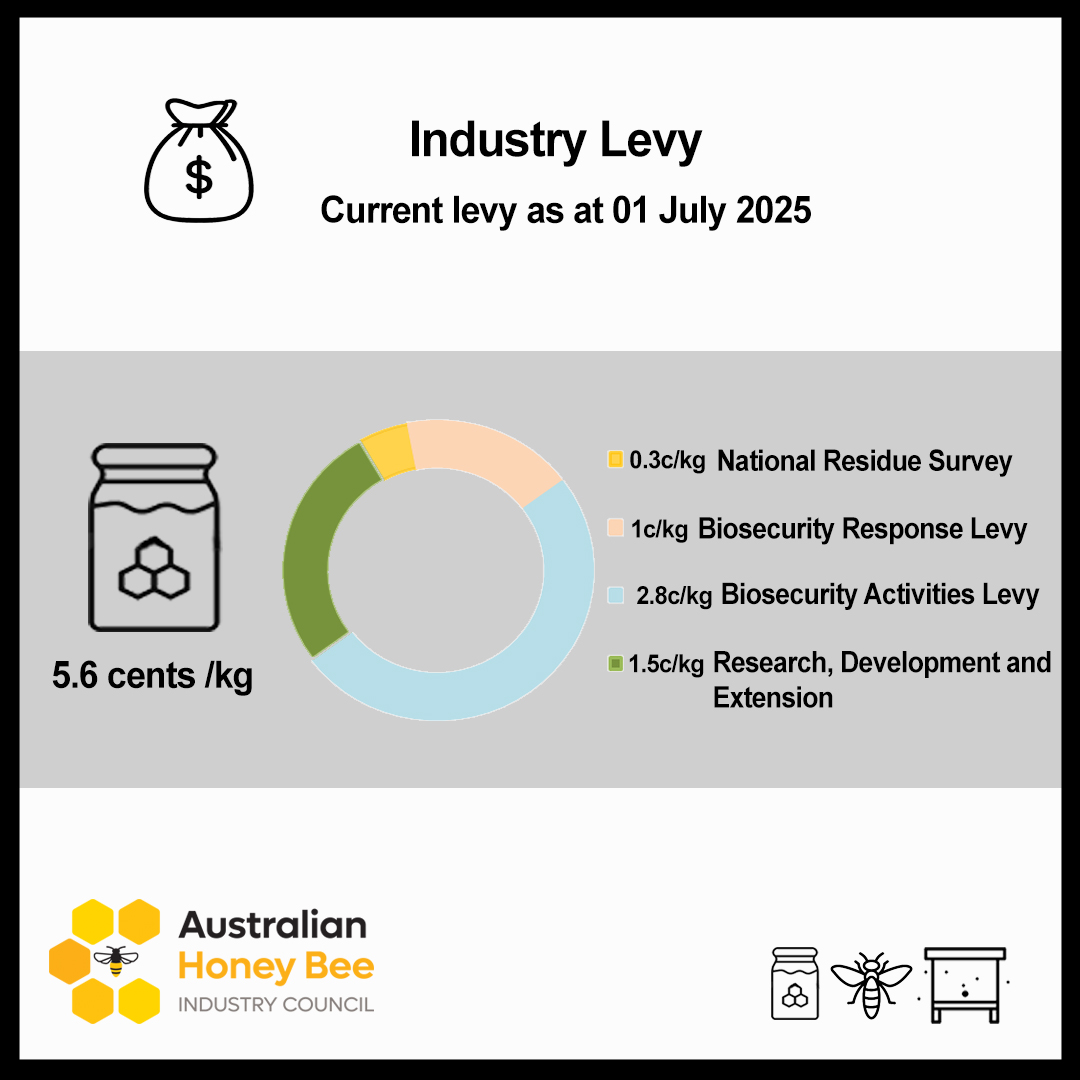

The honey levy is a federal compulsory charge collected on all honey produced and sold in Australia at the first point of sale. It’s currently set at 5.6 cents per kilogram, and it applies to both commercial and amateur beekeepers who sell over 1,500kg per annum. While the amount per kilo might seem modest, when pooled across the nation’s beekeepers, the levy becomes a vital source of industry funding.

From 1 July 2025, the levy was increased by 1 cent per kilogram from 4.6 to 5.6 cents per kilogram. This temporary increase will be in place for six years and is specifically designated to repay the debt incurred from the national response to the Varroa mite incursion. This includes paying our share of the many services you may have participated in through the T2M program including Varroa Development Officers and training.

Who Collects the Levy?

The honey levy is collected and managed by the federal Department of Agriculture, Fisheries and Forestry (DAFF). DAFF is responsible for administering all agricultural levies in Australia, ensuring they are collected fairly and used appropriately.

Importantly, the Australian Honey Bee Industry Council (AHBIC) – while central to the honey bee industry – does not receive levy funds directly. Instead, AHBIC plays a crucial oversight role on behalf of industry, helping guide and monitor how the levy funds are spent to ensure they deliver real benefits to beekeepers.

Levy funds are split across several key areas that support the sustainability and growth of the beekeeping sector:

Why should the levy system matter to you?

Whether you’re running a few backyard hives or managing a commercial operation, the honey levy helps ensure our industry has the tools, science, and systems it needs to thrive. While you may not see the direct impact every day, your contributions fund the research, biosecurity, and advocacy that protect your bees and our broader pollination-dependent agriculture.

In short – it’s an investment in the future of beekeeping in Australia.

The National Residue Survey randomly tests 180 honey samples from around the country for a long list of residues. This program is in place to monitor chemical residues in honey, helping protect Australia’s reputation as a supplier of clean, safe, premium honey.

Administered through Plant Health Australia who provides a funding mechanism to contribute to National Cost-Shared Biosecurity Response costs, apportioned to the honeybee industry: examples of recent cost-shared responses include NSW Varroa Response and Transition to Management, Asian Honey Bees in Townsville, Red Dwarf Honeybees in WA.

Administered through Plant Health Australia a portion of the levy is used to deliver key programs that industry has agreed to. The important biosecurity programs that are funded through levies include:

- Plant Health Australia Membership – National coordination of plant pest responses, BOLT course

- The National Bee Biosecurity Program which provides funding to jurisdictions for the Bee Biosecurity Officers (BBO’s) in each state. It was also the original source of funding for the development of the Biosecurity Code of Practice.

- The National Bee Pest Surveillance Program that is a partnership between pollination dependent industries to provide port surveillance at high-risk ports around the country.

Managed via the Honey Bee and Pollination Panel through RDC AgriFutures Australia, levy money funds research projects that improve hive health, pollination efficiency, pest and disease management, and honey production methods.

So How do Beekeepers Contribute to Levies?

The statutory levy system works by beekeepers self-reporting to the federal

Department of Agriculture, Fisheries and Forestry’s.

- business name

- address and phone number

- ABN or ACN.

Beekeepers can choose to do returns annually or half yearly. Once registered you get a email reminder each time your honey levy return is due.

What Is AHBIC’s Role Then?

AHBIC is the peak body representing the interests of Australian beekeepers, from hobbyists to large commercial operators. While it does not receive levy funds itself, AHBIC is responsible for overseeing how the levy money is spent, ensuring transparency and accountability.

In practical terms, AHBIC provides industry advice to DAFF, sits on advisory committees for research funding, and liaises with government agencies to ensure levy investments align with the needs of beekeepers.